I‘m waiting to meet Jeff Okrepkie near a melted swing set in Coffey Park, the middle-class neighborhood in Santa Rosa that was obliterated last fall by fire.

It is early August and there are signs of renewal. In lots scattered about the charred landscape, the frames of new houses are rising. Developers are opening model homes, enticing refugees to rebuild.

Okrepkie, 39, parks his car and we shake hands. “It is hard to comprehend what happened,” he says. In the early morning hours of Oct. 9, 2017, Okrepkie hastened to evacuate his family as the Tubbs fire rained hot embers onto his lawn. He triaged, grabbed a fire safe stuffed with documents and left photo albums behind.

In the aftermath of disaster, Okrepkie and his burned-out neighbors formed Coffey Strong, a resource group for those hoping to rebuild. As an insurance broker, Okrepkie is able to help others navigate the complexities of dealing with developers who smell a bonanza.

“Coffey Park is a paradise for developers,” Okrepkie says. Santa Rosa and the utility companies are restoring damaged infrastructure—parks, roads, electrical, water and sewage services—at no cost to builders. There are public funds for debris removal. But the survivors are mostly on their own. This is America: no socialist freebies here.

For Coffey Parkers who own a burned lot, there is the possibility of rebuilding—if there is enough insurance money left over after paying off the home loan. Mortgages survive fires, even if homes don’t.

Santa Rosa permitting data and interviews with construction, insurance and banking experts reveal that more than half of the burned-out Coffey Park residents are not likely to return.

Some homeowners have sold their ashen lots to land speculators in order to avoid the emotional hassle of recreating hopes and dreams. Some sell and migrate to cheaper housing climes because their homeowner’s insurance does not cover the cost of rebuilding—costs which have ballooned in the wake of disaster. Renters? Long gone.

UNDERWATER BLUES

Sonoma County–wide, about 5,300 structures were lost to the fire, with about 1,400 houses carbonized in the area of Coffey Park. The city of Santa Rosa lost about 3,000 homes. The California Department of Insurance calculates the county’s fire losses at $8 billion.

That is a lot of money, but it is not enough to repair the damage. Two-thirds of Coffey Park homeowners are “underwater” on their insurance coverage.

What happens when an insured house goes up in flames? Standard contracts ensure that the mortgage will be paid off before a homeowner palms a dime. Whatever cash is left over can go toward the cost of rebuilding, relocating—or feeding a slot machine at the Graton Casino.

Homeowner policies limit the cost of materials and labor for rebuilding. The dollar cap is often set decades prior to a disaster. Emily Rogan of the consumer advocacy group United Policyholders, says that many people neglect to update the cap out of ignorance that it matters, or because raising it increases their premium. And, after all, fires are what strike other folks.

If the cost of rebuilding a home purchased in 1998 was $100 a square foot, an owner would be shocked to learn that it costs four times that amount to replace it. The reason is twofold: The price of materials and labor has increased over time with inflation, and a sudden demand for local construction services in a disaster zone causes unregulated prices to explode.

The low end of a Coffey Park rebuild pencils out at $280 per square foot, and that is likely to produce a smaller house than what was there before. Replacement is reaching as high as $400 per square foot, more if a homeowner wants the Italian marble.

The good news is that many rebuilders are taking out bank loans to cover the gap between insurance proceeds and costs. Interest-only rates on construction loans are about

6 percent, but after the house is built, owners can refinance into a 5 percent mortgage.

The bad news is that local lenders such as Poppy Bank, Exchange Bank and Redwood Credit Union require a minimum down payment of 20 percent cash, and it can be much higher. There go the college funds, the pensions and the cookie jar.

In fact, there goes the neighborhood.

Santa Rosa permitting data shows that about 300 houses are under construction in Coffey Park. Citywide, about 600 houses are under construction, and 500 are flowing through the permitting pipeline. That is about one-third of the 3,000 homes incinerated inside city limits by the Tubbs fire. It will take years for the community to recover; meanwhile, construction firms, land speculators and bankers are riding a boom.

A few Coffey Park developers are offering custom-designed, pricey homes; some are marketing cheaper, cookie-cutter houses. All of them want your money locked up in an escrow account before they will pound a nail. The tightly controlled escrow process is supposed to be overseen by neutral third parties who are mandated by law not to favor any party in a transaction.

And therein lies the gravamen of our tale.

[page]

THE FAMILY BUSINESSES

Only one of the builders operating in Coffey Park, Gallaher Homes, steers its clients toward a preferred bank. Headquartered in Santa Rosa, Poppy Bank is controlled by the owner of Gallaher Homes, William P. Gallaher. The cross-ownership is a recipe for conflicts of interest, say banking experts who reviewed the situation at the Bohemian‘s request.

Gallaher is a prolific developer. He and several of his family members are prominent public figures in Sonoma County. They operate the Oakmont chain of senior living centers; they invest millions of dollars in real estate ventures; they contribute heavily to the campaigns of local politicians who vote on land issues.

Last year, the Sonoma County board of supervisors awarded Gallaher a contract to redevelop the Chanate hospital complex in Santa Rosa. (The agreement was canceled in July by a superior court judge after neighbors sued, alleging environmental and other harms to the public weal. See “Judge Spikes Chanate Agreement,” July 16.)

Gallaher is chairman of the board of the $1.6 billion Poppy Bank, known until recently as First Community Bank. His daughter, Molly Gallaher Flater, sits on the Poppy Bank board of directors, as does William Gallaher’s brother, Patrick.

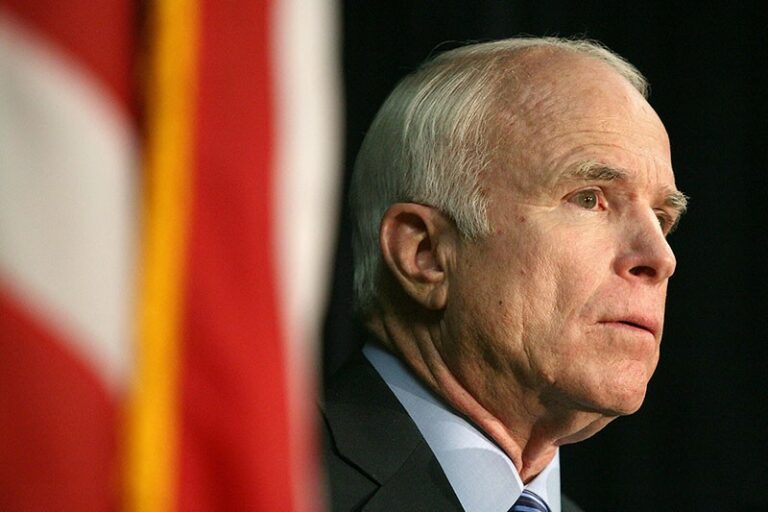

The governing panel includes Doug Bosco, the former Congressman who is a partner alongside political lobbyist Darius Anderson in Sonoma Media Investments, which owns most of the print media in Sonoma County, including the Press Democrat.

In its reporting on Coffey Park, the Press Democrat regularly lauds Gallaher Homes’ “partnership” with Poppy Bank in Coffey Park as a “one-stop” solution to the housing crisis, without disclosing that Bosco is a director of the bank.

Poppy Bank was chartered when First Community Bank merged with Blue Gate Bank earlier this year. Gallaher and Flater founded Blue Gate Bank in 2016 with a $30 million capital infusion. Gallaher and Flater served on the board of Blue Gate, as did Gallaher’s business partner and employee, Komron Shahhosseini, who is a member of the Sonoma County Planning Commission. Khalid Acheckzai was appointed CEO of the merged banks, which feature a poppy as its logo.

Gallaher Homes is a family-owned and -operated residential developer. According to its website, Gallaher heads the firm he founded in 1979. His wife, Cynthia, is in charge of project design. His son, Will, is an executive. Flater is the chief operating officer, and in charge of the firm’s flagship “Bring Back Coffey Park” project.

Gallaher Homes offers a range of ready-to-roll floor plans at varying costs, all pre-permitted by the city. Brochures distributed by Gallaher Homes at its Coffey Park model home, and on its website, strongly urge potential clients to finance their rebuilds with Poppy Bank—in order to smooth the process and to avoid adverse consequences such as construction delays.

The company advertises, “Gallaher Homes has partnered with Poppy Bank to create a streamlined, easy, and hassle-free financing solution for homeowners.” The bank’s “escrow” officers will “expedite” the nitty-gritty of the rebuild, including ordering building inspections and authorizing disbursements to Gallaher Homes.

And then comes the warning.

Gallaher Homes cautions: “We cannot guarantee a 180-calendar day build time for homeowners utilizing their existing lenders.” Banking experts consulted by the Bohemian say that creating disincentives for not using a preferred bank is a troubling business practice.

PJ Garcia, senior vice president of the Escrow Institute of California, a trade association for escrow officers, opined that it is not ethically acceptable for a bank to perform escrow functions in a deal involving its board members. She is concerned that Gallaher Homes’ warning that clients who do not use Poppy Bank may experience construction delays is a disincentive to using another lender.

“Disincentives are not allowed under lending regulations,” Garcia remarked. “Even if Poppy Bank discloses Gallaher’s control of the bank and Gallaher Homes to its Coffey Park loan clients, the mandate that the escrow process remain neutral is called into question by the very existence of the cross-ownership relationship.”

Poppy Bank’s chief lending officer, Tony Ghisla, says that

the bank is financing about

80 rebuilds in Coffey Park

and is committed to investing

$325 million countywide. “We are trying to accommodate people who are in a tough spot,” he says.

Poppy Bank offers prospective construction loan clients an “insurance claim package” for processing claims for use in rebuilds, with the caveat, “If you want to use your insurance proceeds to rebuild, we need to make sure that your contractor is qualified.”

Ghisla explains that before Poppy Bank authorizes a client to work with a developer in Coffey Park, loan officers “review the contractor’s ability to make a project happen.” He declined to reveal how many of the bank’s Coffey Park clients are using their loans to pay Gallaher Homes for their rebuilds. “I have not gone back and looked, but there is a mix,” he says, adding that “Bill [Gallaher] is a general contractor” approved by the bank.

Nowhere in its “Bring Back Coffey Park” promotional materials does Gallaher Homes reveal that its owners also own Poppy Bank. “Bring Back Coffey Park” recently morphed into “Bring Back Sonoma County,” but details of the firm’s declared partnership with Poppy Bank remains the same.

As a selling point, Gallaher Homes tells prospective clients who lost homes to the fires, “If you need financing, you will meet with Poppy Bank or another financial institution that meets our lender requirements to discuss funding options.”

But if a prospective clientGallaher Homes related escrows should not be deposited at or controlled by Poppy Bank. uses another bank, “Construction Admin [sic] will not include review of or approval of any subcontractor contracts, invoices, preliminary notices, or payments.”

Another bank may or may not be inclined to accept such a limit on its ability to oversee the progress of a construction project. Exchange Bank vice president Kevin Smart says his bank “is comfortable working with Bill Gallaher.” Gallaher Homes may be delivering good work, but that is not the issue that concerns the ethics experts.

Ghisla confirms that Poppy Bank’s building inspectors and escrow officers review construction and billing details before authorizing payments to Gallaher Homes and other developers. “We get copies of all the invoices before authorizing advances to a contractor,” he says.

Loan officers at Exchange Bank and Redwood Credit Union apparently do the same, but with one important difference: their bosses do not own the developers whose work they must inspect before signing off on payments.

Promotional material for “Bring Back Sonoma County” continues, “[A]fter your initial meeting with Poppy Bank, we will verify your eligibility and pre-screening results. You do not need to provide any documentation to us after this pre-screening appointment, as we will be in direct communication with Poppy Bank. This is one of the many benefits of working alongside our local, partner bank.”

According to “Bring Back Sonoma County,” rebuilders who contract with Gallaher Homes and finance with Poppy Bank must deposit the cost of the rebuild, including insurance proceeds, personal savings and bank loans into an escrow account at Poppy Bank. “If you have all cash to build your home . . . the funds covering the total cost of the build will be put into an escrow account at Poppy Bank, who will oversee the release of funds and inspections. Poppy Bank has local escrow officers and inspectors who are dedicated to meeting the stringent timelines for the release of funds to streamline the construction process.”

And therein lies the rub.

Jamie Court of the nonprofit consumer advocate Consumer Watchdog reviewed the “Bring Back Sonoma County” materials. He says that due to the cross-ownership issue between bank and developer, Gallaher Homes–related escrows should not be deposited at or controlled by Poppy Bank.

Court emphasizes that escrow funds are required to be managed by neutral third parties without any financial interests in the outcome of a deal. “At a minimum, the shared ownership relationship between Gallaher Homes and Poppy Bank must be formally disclosed to the homeowner under federal lending laws,” Court says.

Ghisla counters that the cross-ownership situation is disclosed to its Coffey Park clients during the loan-closing process. “There is a document,” he says. “We let them know there is a relationship between the bank and Gallaher.” By closing time, of course, most clients are more than eager to sign the dotted line.

BREAKING THE SILENCE

An email from Lila Mirrashidi, deputy commissioner of the California Department of Business Oversight, which regulates Poppy Bank, explains that “California banking regulations are silent regarding whether a bank may act as the escrow officer in a loan that benefits an officer/owner of the bank.”

But Stanford University Graduate School of Business professor Anat R. Admati, an authority on banking ethics and regulations, is not silent. “In theory,” she says, “the arrangement could bring efficiency and cost savings to benefit all sides because there is ‘trust’ between the builders and the bank.

“That said,” she continues, “the arrangement raises the possibility of conflicts of interest and self-dealing, which can endanger the bank and extract excessive fees from the customers and distort competition. Loan rates might be higher.”

The Bohemian‘s investigation found that the loan rates and terms of three major local banks making loans in Coffey Park—Poppy Bank, Exchange Bank and Redwood Credit Union—are in the same ballpark. Each bank has designed loan products specifically for rebuilding in the burn zone. But only one, Poppy Bank, is cross-owned with a Coffey Park developer.

Admati explains why that matters: “From a governance perspective, the board of Poppy Bank is not truly independent. The cross-ownership connection could distort the banks’ decisions. Can management say no to funding the construction projects if several board members stand to benefit, even if indirectly?”

It’s a tightly knit board of directors. Three Gallaher family members serve on the board of Poppy Bank, and an executive with Gallaher’s Oakmont Senior Living, Steve McCullagh, is also a board member, as is Ajaib Bhadare of Billa Management, who has partnered with Gallaher in several business ventures.

Admati says the Coffey Park situation has national implications. “Independent governance is especially important in the context of rapid growth of an activity, such as exposure to construction loans and too many insider transactions,” she says. “These concerns raise potential safety and soundness issues for the bank, which regulators, and all of us, should worry about because Poppy Bank’s deposits are FDIC-insured.”

Admati adds that there are reasons why banks and developers should stay in their own lanes. “Traditional banking laws,” she says, “have created clear separation between commerce and banking precisely to avoid banks directing credit on favorable terms only to connected businesses.”

In the banking industry, even the appearance of a conflict of interest or self-dealing can be damaging. Banking-industry expert William K. Black of the University of Missouri says that “‘Bring Back Sonoma County’ sounds like a classic tie-in sale that is prohibited for obvious reasons. You are not supposed to be able to use your banking power to make people do something else in another corporation you own. It should also be terrible publicity. It is the type of thing you would not normally do because you look bad. Regulators should order an immediate halt to it.”

That decision would be up to the California Department of Business Oversight.

[page]

INSIDER LOANS

Federal banking regulations require banks to disclose insider loans of more than $500,000 upon demand by a member of the public. Poppy Bank has disclosed to the Bohemian that, as of the end of June 2018, the bank has extended credit in excess of a half-million dollars to the following board members:

• William Gallaher, the founder of the bank

• Ajaib Bhadare, real estate investor and Gallaher business partner

• Ron Carli, agricultural banker

• Louis Ratto, real estate investor, former owner of Redwood

Empire Disposal

The head of Poppy Bank’s compliance unit, Randall Dove, would not reveal the amounts or purposes of the loans made to the bank directors, but public records reveal that in 2009 the bank made a

$4 million loan made to William and Cynthia Gallaher. In July 2018, Poppy Bank made a $4 million construction loan to Molly Renee Gallaher Flater, records show.

That means that nearly half of the bank’s 13-member board have been granted millions of dollars in loans, presumably authorized by a vote of the board itself.

Federal and state banking regulations frown on banks making loans to their board members and their related businesses. For example, in its handbook on conflicts of interest, the federal Office of the Comptroller of the Currency cautions bankers to avoid self dealing: “Self-dealing occurs when a bank, as fiduciary, engages in a transaction with itself or related parties and interests.”

There is a loophole, of course. Bank boards are required to approve or disapprove requests for “insider” loans made by board members. The terms of the loans to insiders are not allowed to be more favorable than the terms available to the general public.

Poppy Bank declined to comment on the terms of its insider loans, or whether the credit extensions to board members were approved by the board. Gallaher and Flater did not respond to multiple requests for comment.

In a telephone interview, Bhadare said, “I have multiple loans with Poppy Bank that were approved by the board.” He declined to reveal the terms or the amounts of his loans or their purposes.

Lila Mirrashidi of the California Department of Business Oversight said that the agency reviews insider loans made to directors for compliance with regulations, but that the results are confidential. —Peter Byrne