11.19.08

NO EXIT: National bankruptcy filings are exponentially increasing, and increasingly more difficult to enact.

By P. Joseph Potocki

S houlders squared, jaw thrust defiantly out, I reached for the door to the Federal Bankruptcy Court in downtown Santa Rosa. It was a warm and sunny late May morning. I’d spent months plowing through paperwork, pulling out clumps of hair and reconditioning my backbone, preparing for this very moment. A strange psycho-kinship with Bert Lahr’s Cowardly Lion had grown inside me as I prepared to engage a similarly great, powerful and really scary wizardry. Having for many months played out alternately ruminative and then self-loathing excitations, as though completing this process required each day for my yin to duke it out with yang, finally, my paperwork was assembled and I was set to enter the vestibule leading to the federal crypt of my financial ruination.

My plan was to swing open the door, beeline it to the clerk’s counter, plunk down the fee, file for debt relief and slither away incognito. Instead of making a quick break to the counter, I was greeted by two uniformed officers, each smiling knowingly and laconically, instructing me to remove my belt, empty all pockets and place everything, including my wretched ream of requisite paperwork, onto an X-ray conveyor belt.

That’s symbolism for you, subtle as the plague. But only just now has that symbolism dawned on me, fully six months after the fact. Perhaps that’s because when soliciting bankruptcy’s scarlet letter, one is more inclined to focus on the deed’s radioactive fallout than on some ethereal symbolism, no matter how blatant the empty-pocket motif. Still, I swear I could hear insolvency’s cosmic jester squealing himself silly with glee at my filing, for yet another poor mortal schlub had just checked into his Hotel California.

Or, well, maybe not.

A Nonexclusive Club

According to the National Bankruptcy Research Center, October’s consumer bankruptcy filings skyrocketed 40 percent from the year before, fully 20 percent higher than September. From the first of this year through Halloween, over 900,000 people filed for personal bankruptcy. And looking back, 2007’s numbers far surpassed those filed in 2006, it being the first full year the highly contentious Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 was enforced. This draconian legislative gem, a credit-card-industry-writ wet dream come true, makes qualifying for Chapter 7 bankruptcy a far more costly and difficult affair.

Consider for a moment that somewhat more than 300 million Americans are breathing and buying stuff today. As of July 2008, our combined national credit card debt stood at $962 billion and rising. That means, on average, each household carries about $11,000 on credit cards alone, never mind mortgages and other ongoing financial commitments.

Chapter 7 leaves the debtor with a nearly clean slate when all is said and done. However, while Chapter 7 provides individuals relief considerations, one’s credit is toast for at least seven years. But, once bankruptcy is granted, should one work hard, live frugally and, as penance for sins against capital, endure years of want and consternation, one reemerges a credit-worthy phoenix, ready to gingerly reengage the credit-debtor mainstream.

That’s because capitalism requires we prodigal sons and daughters return to its fold in order to ensure capitalism’s own survival. Perhaps authors of the Bankruptcy Abuse Prevention and Consumer Protection Act forgot this. I say this because were he not rehabilitated, but instead permanently vanquished, the debtor would be lost to agencies of credit forever, made an outlaw, hermit or kook, and thus be unavailable to institutional juice rackets for future capital bleeding.

But even after a Chapter 7 bankruptcy discharge, not all debts go away. Back taxes, child support and student loans do not get eliminated by Chapter 7, though unsecured debt (i.e., credit cards) pretty much does. That’s the reason why credit card companies aren’t too keen on folks filing Chapter 7.

The plastic camp’s comeback was to write, lobby hard for and, after innumerable legislative disappointments and with Blue Dog Democratic support, ultimately shove a bill through the 2005 Republican Congress, gifting the credit card companies by screwing the consumer. George Bush, no doubt, took enormous delight in inking this class war declaration.

Though we’re closing in on three years since its passage, this bill, commonly referred to as the “New Bankruptcy Law,” imposes higher filing fees, mandates that a petitioner pay for and complete credit counseling, and lards on additional paperwork, compelling most attorneys to double fees for essential bankruptcy services. Most notably, by injecting “means testing,” which is designed to disqualify many people who wish to file a Chapter 7, those turned away, should they still insist on going belly up, have been obliged to seek the far more costly and drawn-out [insert horrific organ shrills and a deep bass dum-de-dum-dum] Chapter 13 bankruptcy instead.

Earlier modern-day bankruptcy laws were designed to give a fresh start to those whose debt load was so heavy they’d never get out from under it. The idea isn’t so much an altruistic or magnanimous one as it is a rational understanding that people with crushing debt are a drain on society as a whole. The deeply indebted may even pose serious threats to the social fabric, should they engage in illicit activities, taking desperate actions to relieve their condition.

Still, while the intent of this most recent bankruptcy legislation was to inhibit folks from filing, it’s failed big-time. The scheme was to punish those who insist on filing by creating smaller, higher and more numerous new hoops for them to jump through, and by levying additional fees while providing a bogus alternative route to debt settlement via industry-funded “nonprofit” debt-collection agencies, established to surreptitiously do the credit card industry’s dirty work.

But get this: With a month and a half left in 2008, the first 10 months of this year’s bankruptcy filings already far eclipse those of 2007. What this means is that by year’s end, more than a million Americans will have chosen to lose or will have filed to lose significant chunks of their worldly possessions—fair, square and legal. All this even before George W. Bush’s Orwellian “ownership society” expels its last ghoulish gasp.

(And, it seems, Dubya’s pals, the very same guys who literally conceived, designed and implemented our “New Bankruptcy Law,” and have driven the world economy to ruins, won’t face bankruptcy themselves, but can be found instead feasting on bailouts ladled out by Henry Paulson at the taxpayer trough.)

Strike, Struck, Striken

“Hold on one darn second there, fella,” comes the fair-minded retort, “aren’t you just excuse-making with fancy smoke and mirrors, aiming to defray your own fiscal missteps and shortcomings at the expense of easy targets? How about addressing your own mistakes and taking personal responsibility for your actions?”

OK, then. You’re absolutely right. I take 100 percent full credit for my personal financial tribulations. While we as a culture have plenty to blame an inequitable financial system for, my personal misadventures in capitalism were definitively of my very own making.

That’s partially because I knew better, and screwed up anyway. I tunneled my way into credit default after a lifetime of scrupulously avoiding plastic and massive debt.

Here’s how it happened. My wife was working at a brokerage firm and doing pretty well. This allowed me the luxury of a few years of research, writing and lecturing, which, shall we say, didn’t exactly pay the bills, even though her work did. Finally, it was gently suggested I find the means by which to supplement my meager income.

I first cast about for ways to bring home the bacon that didn’t necessarily involve hard work. There wasn’t much to choose from. Taking stock of my skill set, it occurred to me that I was passably good at least three things, namely: reading, writing and holding forth. San Francisco being our residence at the time, it struck me that visitors might actually pay me to drive them to and fro, regaling them with fun-filled facts, figures and fables regarding our most famed and beautiful Bay Area environs. I’d provide high-end, personally customized tours of the city, Monterey, Yosemite and wine country to cultured individuals with really deep pockets. Hallelujah, these tourists were aching, I was certain, to pay me fat, easy money for a really good time!

Jeez—the impenetrable depths of self-delusion. All it took was the two-week 2004 San Francisco hotel strike and its subsequent seven-week lockout aimed at all but one of the hostelries at which I’d curried concierge favor to bring my little business to its knees.

Me being rust-belt born and bred, I had and still maintain well-defined sensitivities to labor. I never, ever cross a picket line. This, however, was the first time my support for labor actually cost me mine. That said, I don’t regret it. Self-dignity, too, is pricey.

I conducted not one tour during the nine-week course of this strike. Once the matter had been settled, the concierges I had so fawningly cultivated were perfectly content to ladle out tours I might have conducted to other tour firms who’d shown no compunction about crossing picket lines in the service of the moneyed caste. It was all quite understandable, but understanding it didn’t address my ever-mounting debt. And with debt came it’s attendant demons: vodka, filterless coffin nails, mounting fat, marital anguish and severe depression. My cholesterol and blood pressure skyrocketed, and I was on the verge of diabetes. I could see no possible way out. I even briefly fantasized a really terminal solution.

Fortunately, we decided to cut costs, move up to Sonoma County and do the conventional work thing. But even with steady work, the bills kept mounting. Credit agencies assured me I’d not be forgotten, and I could barely make it out the door to work each day. The remainder of my hours I drank, slept or shoved that day’s stack of bills atop its growing sibling’s mountain. I even took a meeting with a kind and thoughtful credit counselor who told me, “You’re fucked.”

And it’s not like I didn’t see the train wreck coming. Fact is, prior to this, I’d long been philosophically opposed to living beyond my demonstrably simple means. I knew credit cards were nothing but trouble, but came to a point in life where I joyfully deluded myself into believing I was ripe to try my hand at hardscrabble “bizness.” My foregone conclusion was that success would be mine, reflecting on potential negative repercussions every bit as long and thoughtfully as Sarah Palin reflected on the offer of the vice presidential nomination.

I seduced myself into believing that by signing up for one, two, three, four—or even five, hell, who’s counting—of the siren-sounding offers landing in my mailbox each day would merely jump-start my can’t-miss business. I’d use plastic scrupulously, pay off my debts each month, then cut up the cards and be done with them, using them but briefly to launch me toward that first hard-earned million.

So here I was, embracing modern credit innovations, keeping up with the times and going with the flow. I’d bought my own bullshit, and on high-interest credit. Indeed, I’d finance my small business the new-fashioned American way: naively and stupidly. Damn, it was so quick, and so insanely easy, using credit cards to keep my tiny concern afloat, while fate tap-danced all over it; using plastic to make van payments, sky-high commercial insurance payments, promotional costs, travel expenses, state fees, taxes; finally, even using plastic to meet basic living expenses, awaiting the big payback, while medical bills piled up and my ultraspecialized business sank into the dead zone.

Bankruptcy Chic

Early-American debtors hardly relished being locked in public stockades, suffering the taunts and produce projectiles launched their way. Others spent all their time ensconced in prisons. These unfortunates, in addition to fielding ever-mounting room and board charges to cover their own imprisonment, compounded debts that got them there, with interest. Colonial and even post-Revolutionary imprisonment featured small, stark, stank and drafty jail cells, the so-called gaols, derived from the Latin word for “cage.” Disease was rampant, and like this Bush era, you could be tortured. Not surprisingly, a good many died while confined in debtor prisons.

Back then, one’s former high standing, philanthropies and-or exemplary national service counted for nothing against owing a buck. Take for example one Robert Morris, chief financier of the Revolutionary War and signer of the Declaration of Independence. Morris was our nation’s first Superintendent of Finance, but none of this meant squat when, in his latter years, his investments turned sour. Morris was sentenced and subjected to four brutal years in an American debtor’s prison, prisons which weren’t closed until well into the 1830s.

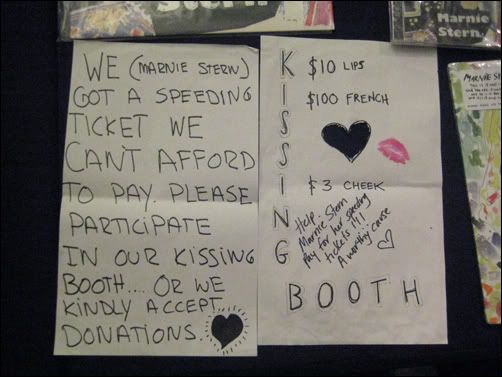

I don’t claim membership to this earlier vanguard movement but do feel part of a recent groundswell. Call it “bankruptcy chic,” though with numbers climbing madly it’ll be hard to keep it an exclusive club for long. The way it’s going, bankruptcy’s destined to become as commonplace as Kleenex.

But for now it remains a timeless and even fashionable club, one whose eminent membership includes Henry Ford; Donald Trump and fruit-juice maven Anita Bryant (each of whom went broke twice); Milton Hershey, Henry John Heinz and Meat Loaf; industrialist Charles Goodyear; kings Edward II and Phillip II; Rembrandt, Handel, Mozart and Gutenberg; presidents Jefferson, Lincoln, McKinley and Grant; sporting greats Bjorn Borg, Lawrence Taylor, Steve Howe and Johnny Unitas; showbiz stars Lynn Redgrave, Richard Harris, Randy Quaid, P. T. Barnum, Larry King, Mickey Rooney, Debbie Reynolds, Buster Keaton, Margot Kidder and even Donald Duck’s dad, Walt Disney; songbirds Tom Petty, Toni Braxton, Mick Fleetwood, Natalie Cole, Merle Haggard, Jerry Lee Lewis, Cyndi Lauper, Isaac Hayes, Marvin Gaye, Tammy Wynette and Willie Nelson—not to mention most of the Jackson clan.

Of course there are reams of famous bankrupt writers, including the wizard himself, L. Frank Baum, Mark Twain, Oscar Wilde, Raymond Carver, Daniel Defoe, Don Quixote’s Cervantes; and bona fide characters like Aleister Crowley, Buffalo Bill and John Wayne “Where’s my weenie?” Bobbitt; even geniuses like Bucky Fuller, Stan Lee and Nikola Tesla, not to mention a host of past and present local lights, including Satanist Anton LaVey, Emperor Norton I, Melvin Belli and Francis Ford Coppola.

So in the end, what’s going bankrupt taught me? Well, it’s led me into a great job, where I’m paid to think. I’ve dropped 30 pounds, exercise daily, have better than optimal blood pressure, take no medications and show no signs of diabetes. I no longer drink, smoke or suffer depression. I’m a recent vegan convert. Our family lives in comfortable “affordable housing,” I’ve crawled out from my cave and have made new, exceptionally wonderful friends, and I look forward to a long winter of writing, reading, plotting, scheming and dreaming—all well within my financial means. Life today is filled with hope and optimism. If that’s a fate worse than debt, well, I’ll live with it.